Many millennials worldwide have earned their first cash by diving into the flipping game. Getting creative with real estate demands a mix of cold calculations, patience, market smarts, hard work, and a dash of selling flair. Unlike stashing money in banks, government bonds, or taking a gamble on startups, successfully buying, fixing up, and selling a property can churn out way higher returns. Today, we want to have a closer look at this business and share a few tips on flipping from Payday Depot financial experts. Let’s dive in!

So, what’s flipping? A flipper looks for undervalued real estate, buys it, gives it a makeover, and then slaps a “For Sale” sign on it with a sweet profit of roughly 30%. Flipping isn’t a typical real estate game where investors track market trends. Flippers often call themselves developers, but they aren’t building any bustling communities or reconstructing entire neighborhoods. They would rather focus on creating smaller projects.

Here are the key ingredients of the flipper’s game:

- Find the prime investment property.

- Juggling project finances: calculating the property cost, covering revamp bills, taxes, and advertising.

- Increasing asset liquidity: revamping, utility swaps, and either major or minor fixes.

- Advertising the property and finding a buyer.

In the US, sprucing up and selling homes has become a side hustle for many young people. It’s a great business opportunity, and with 120–160 million homes up for sale, the competition’s no joke. But don’t think flipping is for amateurs. If you dive into the real estate resale game without knowing the market, you might easily lose.

Where can I get money for flipping?

Flipping requires some startup capital. Professional flippers often snag funds from outside investors to lead their projects. You can count on your personal savings or share the expenses with a team of friends or colleagues and dive into real estate together, spreading the risk. You may also use mortgage money. Go for it if the bank’s throwing low interest rates and no early repayment penalties your way. Remember that the loan should cover both the property purchase and the fix-up.

How do you pick the right property for flipping?

In this case, the location is the king. Try to search for something in your area. You may notice some renovations, get sweet deals on construction gear, and make friends with realtors and handymen. Check out specialized websites, hit up real estate agencies, or try dedicated online platforms. They’ve got the lowdown on houses, cottages, and commercial spaces all over the place.

How to boost that real estate value

- Stage 1: Total Cleanup: It’s either a jackpot with well-kept treasures or a treasure hunt for hidden problems like toilets under tiles.

- Stage 2: Check the Goods: Vintage finds like furniture or bronze faucets can be sold online.

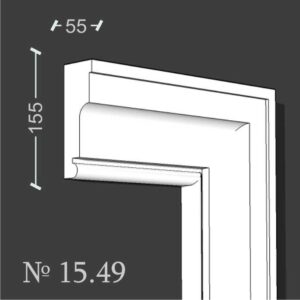

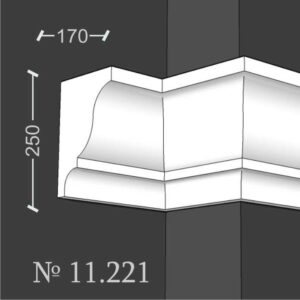

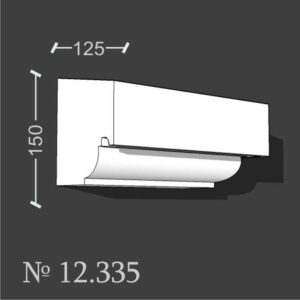

- Stage 3: Revamp: Expenses depend on the property’s condition. Get it in a sellable state by fixing heating, plumbing, fixtures, doors, and floors.

- Stage 4: Home Staging: Bring in the furniture, make it cozy, snap some killer photos, and work your magic on potential buyers. Sell that place with a 25% profit in 2-4 months.